If you are a Chief Information Officer (CIO) of a major telecom operator, you know that keeping up with the evolving trends of the digital ecosystem of telecoms is pivotal. As a MNO executive, you are always on the lookout for solving pain points such as cost optimization, and enhancing customer journeys as you scale your business. To help you along your revenue growth journey, we have extracted and collated a list of the most relevant industry trends from prolific reports that will guide you about the driving factors of the future of the telecom industry.

While the telecom sector has made significant progress in augmenting its digitization journey, you may be struggling against the looming challenges in the dynamic technological and competitive landscape. As we draw near to the end of 2022, a new set of opportunities as well as issues come to the surface which can the future of the telecom industry.

In light of these emerging challenges and opportunities, this list of prevailing trends that drive the industry forward and enhance the digital ecosystem of telecoms will be instrumental in gaining a competitive edge.

For that purpose, we have analyzed the key takeaways from industry reports such as GSMA and the major MNOs’ annual reports, including Orange, Airtel, Vodafone, and MTN. These investment areas will and should form the basis of revenue growth and cost optimization for the telecoms in the year 2023 and onwards.

The Telecom Revenue-Growth Newsletter

Our coveted monthly newsletter compiles vetted insights on creating effective sales and distribution chains that fulfil telcos' revenue goals. That, and a lot more.

Here’s a list of industry trends that will be covered in this blog:

Key takeaways from industry trends and reports for game-changing digital technology

In an effort to facilitate the substantial growth of the subscriber base over the past decade, telcos are seeking new ways to acquire new customers and retain them. What business and operational strategies should the modern MNO invest in to be able to achieve revenue optimization and increase operational efficiency?

Taking into consideration the prevailing trends from the broader telecom industry landscape along with the strategic actions and core initiatives by major telecom groups, there are certain business and operational strategies that every telecom should closely watch and prioritize.

The market maturity and the unique developmental phase of telecom companies largely determine the strategic initiatives that are employed. Study our guide and find out more about how telecom market maturity affects the growth strategy for telecoms.

Below are the elemental strategic actions and trends that are essential for telecoms in the digital age and will be critical in shaping the future of the telecom industry:

1. Digital Sovereignty in expanding markets like Asia and Africa

In growth markets such as Asia and Africa, the digital societies are rapidly advancing and there is increased demand for connectivity. The number of internet users in Africa stands at one third of their population as of now, rising up almost 23% between the period of 2019 to 2021.

As per GSMA intelligence, by 2025, there will be an addition of 600 million new subscribers, predominantly based out of countries like India, China, Pakistan, and Nigeria. In total, the influx of new subscribers would make up around 5.8 billion subscribers to mobile services by 2025, which accounts for almost 70% of the global population.

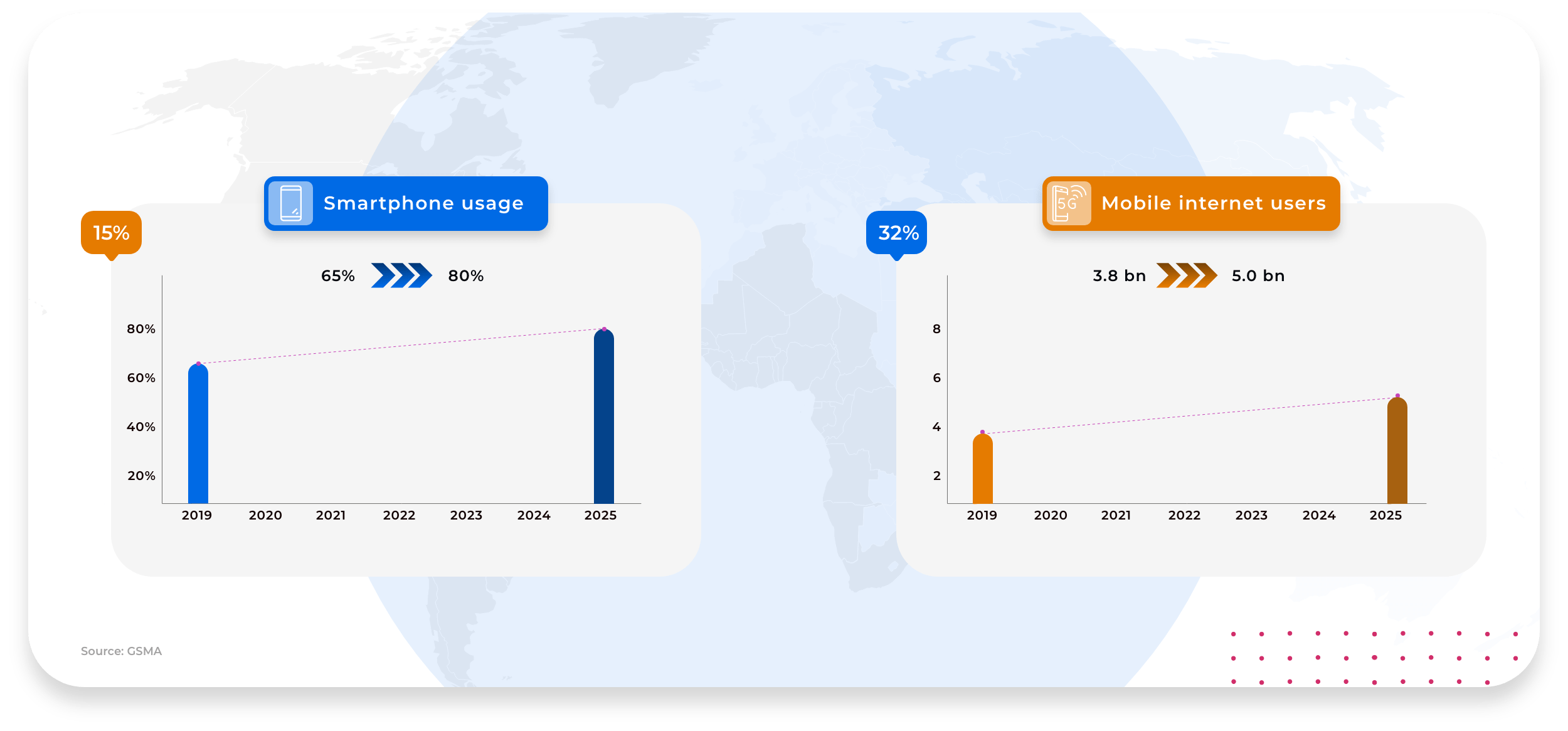

Smartphone usage will increase from 65% of the total number of subscribers in 2019 to 80% in 2025, globally. The increase in mobile internet access is also directly proportional to growing smartphone penetration. Thus, the number of mobile internet users will increase from 3.8 billion in 2019 to 5.0 billion in 2025, a whopping 32% increase.

This needs to be supported by a consistent investment and R&D in the mobile financial ecosystem to drive revenue growth which would be enabled by initiatives in the mobile financial ecosystem that aim to onboard and retain subscribers.

2. Adoption of Cloud Technology

The increased use of IoT devices and Machine Learning Algorithms in the telecom digital ecosystem has led to bulging demand for computing power. Given that cloud computing environment allows more capacity for MNOs, improves resiliency, enables them to scale effectively to meet the rising demands, and easily updates systems, it has become one of the fastest growing trend for telcos.

The essence of cloud technology is such that it enables the MNOs to improve their reach across the industry, and leverages its power to accelerate the digital transformation process to meet the needs of modern customers. Organizations across the board are moving away from their legacy systems, expensive hardware, and device-specific softwares to benefit from more efficient, agile, and scalable shared services and hardware capacity over the cloud.

Keeping in consideration the best practices of telecom industry, here’s how we have employed cloud native technology and microserives to offer greater value to our customers.

3. Accelerated Technological Progress with 5G networks and Internet of Things

Even as the digitization is a must-have strategy for companies in this tech era, the journey itself is laden with a torrent of challenges. This is why MNOs continue to leverage the inherent technological strengths across their distribution network to reimagine their customer journey from a data-driven perspective.

Telcos today are forging ahead in their digital transformation journey, with most of them incorporating technological developments like 5G, Internet of Things (IoT), and Cloud technology, in their business and operational strategy. The ever-increasing data traffic and the evolving needs of the customers necessitates increasingly powerful and secure network systems.

4. Deepening customer engagement and enhancing customer experience

Within the telecom sector, the ecosystem extends far beyond the traditional scope of activities and encompasses not just the basic services of the company but also the non-core and complementary products and services.

The digital consumer of this era has evolved expectations when it comes to product delivery, availability, and customer service. With the wide range of options available in the market, it becomes critical for telecom operators to create tangible value and a key differentiator in their service offerings to retain loyalty. The first step in the process of enhancing customer experience is to understand their pain points. Customers now expect uninterrupted connectivity, a wide range of customized offerings, and quick resolution of their issues.

To bridge this common gap that arises in assessing customer needs, we deploy our high-caliber field sales otimzation tool that turns customer data into valuable insights. Through it, several of our customers have gained access to invaluable insights into their sales operations to exploit new opportunities

5. Driving down OPEX with Automation

With growing competition in the market, the revenue margin for standard telecom services has decreased significantly. Due to this, driving down OPEX in the supply chain has been a primary focus for telecom companies across the industry to maintain a competitive edge. The biggest potential is based on modernizing the existing operational solutions and embracing automation in sales and distribution. See how telecoms can digitize their entire S&D value chain in our detailed guide.

If you are interested in improving your bottom line, we also cover telecom strategic investments that drive revenue growth and optimize OPEX in this blog.

Final thoughts

The insights derived from the reports of various telecom operators have underlying similarities, in terms of challenges and strategic initiatives. However, the impact and reach of business challenges and strategic actions are mainly dependent on the level of market maturity that the telecoms are operating in.

Based on the aforementioned takeaways, a number of conclusions have been drawn and an action plan has been outlined for MNOs so that they can devise the right strategies keeping in mind the future of telecom industry.

If you want to find out more about the industry trends and the operational strategies that need to be prioritized for success in 2023 and onwards, download our comprehensive report “trends and strategic initiatives to achieve telecom growth objectives.”