Introduction

Digital transformation has evolved how telecoms do business – with growth rates of digital connectivity and e-commerce usage, and digital channels of retail distribution reshaping the reality of telecom operators. Some of these changes have meant that the profit margins have grown thinner with customers moving on to direct channels for services. Although this surge in digital adoption also opens up new revenue streams and customer markets for MNOs, it comes with its own set of challenges.

For more details on this, read our white paper ‘2022: The Year in Review for Agile Telecom Leaders’ to learn how telcos are using digital transformation through S&D digitization strategies to optimize profit margins while staying competitive on key industry trends.

How has the evolving playfield of telecom impacted S&D strategy?

As customers are becoming increasingly independent with digital adoption, telcos have been seen to shift their focus to improving retailer productivity through digital transformation in S&D networks. This makes S&D networks and retail operations even more critical to MNOs and so management and insights from retail POS has become a pivotal center for telecom leaders to make key decisions on their indirect sales channel management and growth.

-

Digital literacy

Digital literacy rates have increased at a global level with countries like the U.S. have achieved an 89% digital literacy rate. Yet some countries in Africa, South America, and the Asia Pacific still lag behind when it comes to internet usage. Many consumers within these regions rely on physical stores and agents for consuming network services, as well as purchasing new connections at these outlets.

With digital literacy levels on the rise, and more people using online channels to communicate with businesses, physical stores will become irrelevant in some markets. But for telcos to appeal to both urban and rural consumers through an omnichannel approach, digital transformation in the retail points of sale will still be crucial to maintain a strong multi-directional S&D presence.

-

Digital Infrastructure

The growth of digital infrastructure, smartphone penetration, and eSIM usage has been a catalyst for digital transformation for telcos in five ways:

- Handset shops are traditionally a major source for customers, but with more devices being purchased online, network services are also being sold digitally

- Onboarding processes can now be digitized with eKYC and SIM cards shipped directly to customers.

- Additionally, services like broadband have found a market in smaller Tier 3 towns globally.

- Support channels need to evolve quickly to meet the demand – this may involve IVR and chatbots.

- Lastly, due to the wider adoption of eSIMs, operators will need to develop innovative new strategies to retain their customers as they won’t be able to rely on zero outages or seamless network services anymore.

-

Expanding service portfolio

The use of IoT devices is skyrocketing due to the availability of ever-improving platforms and the upcoming rollout of 5G networks. Satellite internet, on the other hand, is estimated to become a $17bn market by 2030 paving the way for better connectivity both outside and within physical walls. Cloud providers are now on the path to digital transformation and are partnering with telecom players to offer enterprises 5G services through their marketplaces, providing telcos with even more opportunities for growth. These new offerings, as well as existing ones, will cause a proliferation in service portfolios, which will result in the streamlining of supply and distribution channels.

-

Telecom in the extended ecosystem

Consumers are favoring OTT services and niche OTT and community-driven platforms more and more with network services being viewed as more utilitarian instead. GDPR compliance rules make it difficult for telcos to obtain and use first-party data, making it harder for them to properly understand and market to their customers. As a result, the threat of OTTs taking over customer relationships has become very real. This can result in tech providers and OTTs offering network services rather than telcos being the main distributors. With this looming threat, there is a heightened need for MNOs to accelerate digital transformation and level up their S&D retail strategy.

Where do MNOs stand right now?

Mobile subscriptions are tapering off for service providers in the APAC region with a large majority of Asian countries having reached moderate to high penetration for mobile services. Yet, the stagnation is quite high in developed economies like Japan, Korea, and Singapore, with their widespread mobile service penetration.

Even in emerging economies, mobile subscription is going through a downtrend given the trend toward industry consolidation. Largely driven by mergers and acquisitions, there is reduced competition in the telecom market leading to a reduction in overall mobile subscriptions. In developing regions like India, this is even affecting the multi-sim usage of subscribers.

The importance of prioritizing retail sales and selling experiences in pre-paid economies

1. Reducing customer churn

A research conducted by Strategy Analytics (2019) showed that there are eight prepaid-dominant markets: Argentina, Brazil, India, Malaysia, Mexico, the Philippines, South Africa, and Thailand; and concluded that in these markets alone, operators wasted $670 million last year replacing lost prepaid subscribers.

The data indicates that prepaid subscribers are more likely to churn than postpaid ones, which means operators lose a higher percentage of their prepaid subscriber base each year than they do with postpaid subscribers.

2. Prioritizing prepaid services

Although Sweden has a largely cashless economy, it still retains nearly 30% of its market for prepaid mobile users. This shows that the market is ripe for more operators even in more developed economies. In developing economies like Africa, around 99% of subscribers use prepaid services to access a more economical means for voice and data bundles.

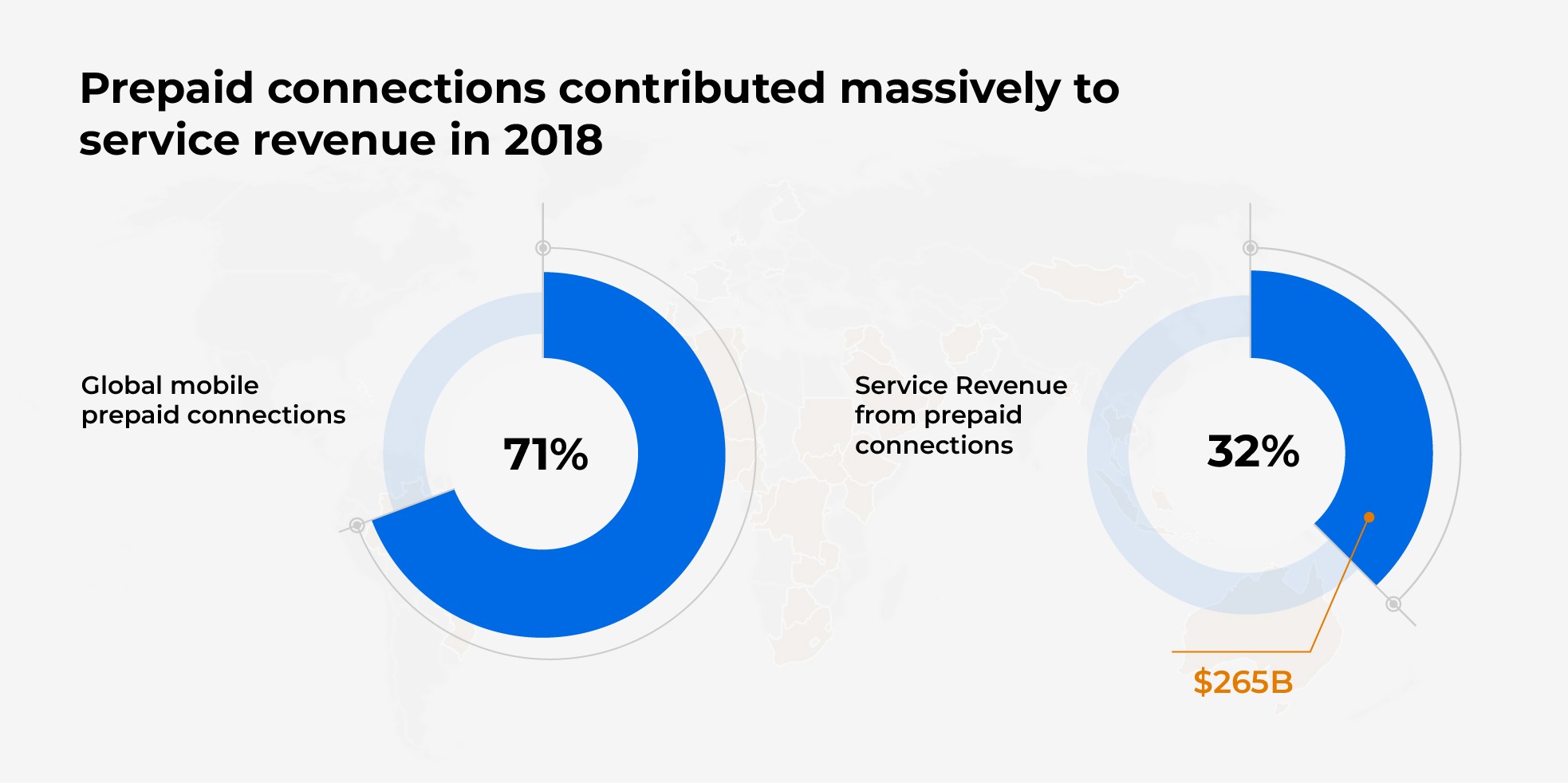

In 2018, 71% of global mobile connections were prepaid and 32%—or $265 billion—of service revenues came from that form. In developing countries such as Africa where populations are growing rapidly but economic growth is slow, a large chunk of all mobile users only use prepaid services: 94% transact on pre-paid plans while 80% pay for their wireless bills this way.

Since prepaid offers a lower price point for consumers, it’s popular across low income households. Consumers are also more likely to pay for their service in advance or as they go, avoiding the upfront cost of a postpaid connection. The trend is likely to continue as prepaid offers a more affordable alternative for consumers who are looking for a way to get online.

3. Offering financial inclusivity

In many markets, prepaid is the only option available to people who don’t have access to credit cards or bank accounts which also makes it the dominant payment method for many mobile users, particularly those in emerging markets. The growth of prepaid has been fueled by new regulations promoting financial inclusion and lowering barriers to entry for consumers who previously lacked access to banking services.

Emerging challenges with this paradigm shift

For most operators, the various parts of their sales & distribution network operate in silos, preventing the leadership from making well-rounded decisions and enhancing customer experience.

The partner and distributor networks operate differently in distinct regions, leading to varying experiences at the point of sale. This creates two problems: it negatively affects customer experiences at the retail POS while also contributing to a loss of millions of dollars in revenue leakage caused by poor trackability of products in the supply chain.

Across our own customers, we have observed that 38% of the products moving across the S&D network are not fully tracked causing severe losses.

There’s a lot of data flowing between a telco’s internal and external systems, be it digital onboarding and retail sales to dealer and incentives management. All this data is critical to uncovering customer behavior and demand by region, cost of delivery and distribution, active-inactive resellers, and top vs poor POS performers, to name a few.

To derive these crucial insights, collecting real-time data from your systems is key because a lapse in information directly impacts the possibility of data-driven planning that drives business results.

By implementing omnichannel retailing across their S&D, telcos can leverage digital transformation across POS channels to provide a smooth and consistent customer experience through all touch points. Doing this not only enhances customers’ overall digital and physical experience but also reduces the user experience gap between direct and indirect channels. Data analytics solutions and platforms can be employed here to not only extract actionable insights and push them to the right stakeholders but to also measure the omnichannel customer experience effectively.

The lack of interconnected systems and data limits the way the broader S&D team operates. Resellers and field sales teams lose out on actionable insights which keeps them from planning their day with higher efficiency.

By introducing the tools that offer this, sales managers can track sales KPIs down to sites and prioritize teams’ visits using targeted recommendations. Field reps can also easily understand which POS needs to be visited first, prevent stock-outs through real-time alerts, and can collect data from the field and share it easily.

At the same time, resellers can participate in digital literacy programs for subscribers that have proven to be effective in improving mobile data usage and repeat purchases at the POS.

Immediate next steps that telecoms leaders should take

Telcos must fuel their digital transformation needs by recalibrating their S&D strategies to keep up with the times, which includes rethinking their channel strategies and cultivating cooperative partnerships with new channel partners. But how? – A critical strategic initiative is to unify all S&D operations to be able to sell any product, through any channel, anywhere all while using data-driven planning and actionable insights to provide efficiency in day-to-day operations.

Benefits of doing this include:

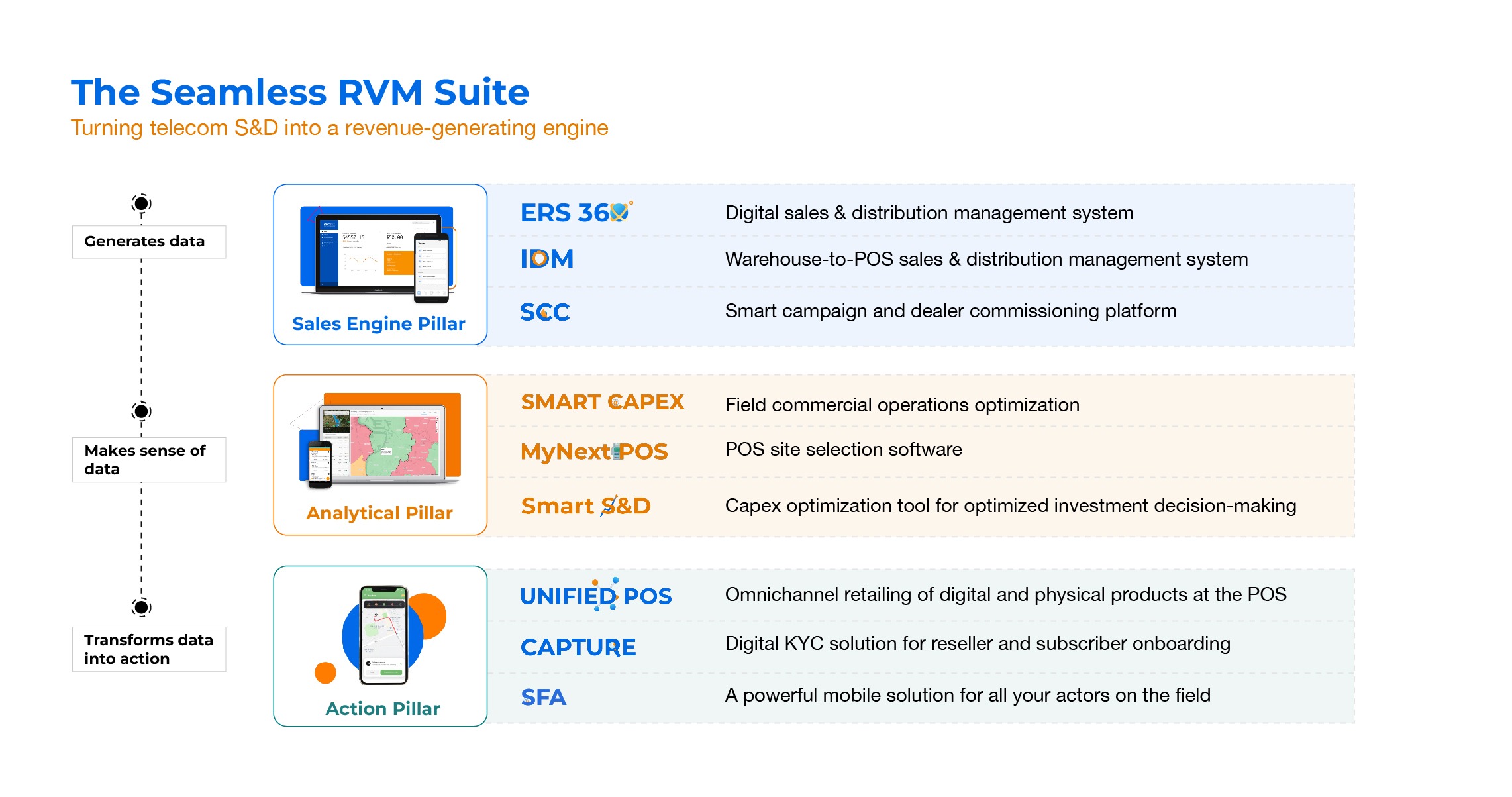

How our product strategy fuels this consolidation for telcos through Retail Value Management (RVM)

With our intuitive RVM Suite, we’ve offered customers an omnichannel distribution management system that provides them with a 360° view of their supply chain. We do this by unifying the three pillars of S&D so MNOs can manage their transaction engine for optimized sales growth, use this data for analysis and transform this data into actions through our recommendation engine.

This empowers MNOs to bolster their strategies with digital transformation and establish a comprehensive system that ensures that they have:

- Customer insights to make decisions

- Sales readiness for reseller enablement

- Multiple touch-points for digital buying and selling to maximize performance

How MTN South Africa grew sales by 18% with the Seamless RVM Suite

The need

- A substantial drop in their subscribers

- Expanding retail offerings beyond prepaid vouchers

- Acquire new dealers

- Increase the visibility of all agent and distributor activities

- Obtain a faster time-to-market by meeting dynamic demand

The solution

Our dealer management solution helped MTN SA maintain indefinite reseller hierarchies and increased control over its distribution network.

By integrating with their Mobile Money ecosystem, we helped their retailers purchase stock from their mobile money accounts. Our smart campaigns and commissions module enabled MTN SA to grow retail sales with targeted campaigns and instant dealer incentives.

The impact

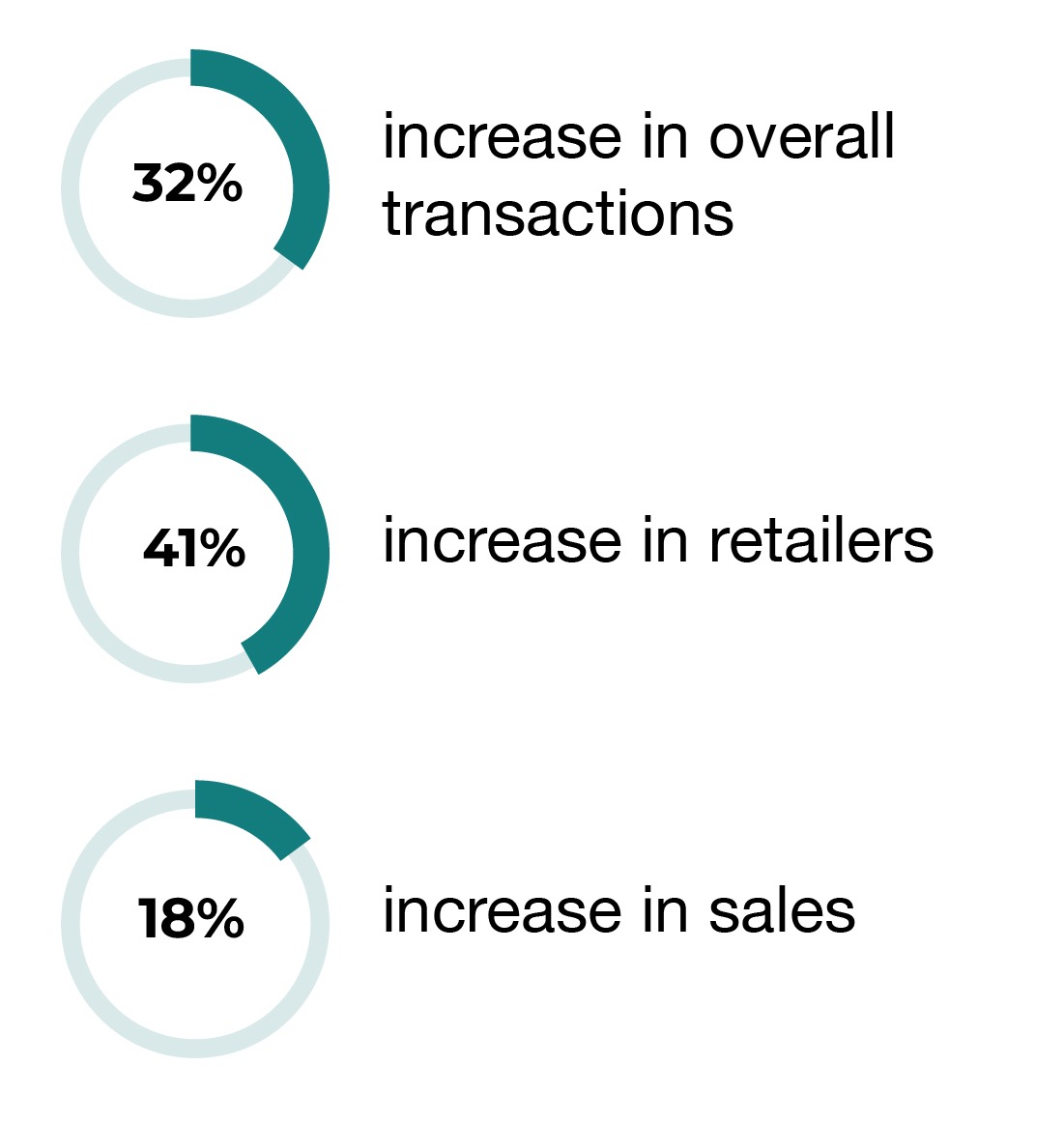

Within 6 months of deploying the RVM Suite, MTN SA saw an impressive:

Final thoughts

Today, it’s increasingly difficult for MNOs to extract value from their sales and distribution systems or launch new products. The way that retail S&D strategies are defined and composed today is dramatically different and instead of having a response-based approach, it’s important for agile telcos to have to truly incorporate digital transformation across their processes. Unifying transaction data to develop actionable insights for POS retail will set the winners apart in developing markets and having a high-caliber ecosystem that meets your unique needs can take you very far, no matter the landscape.