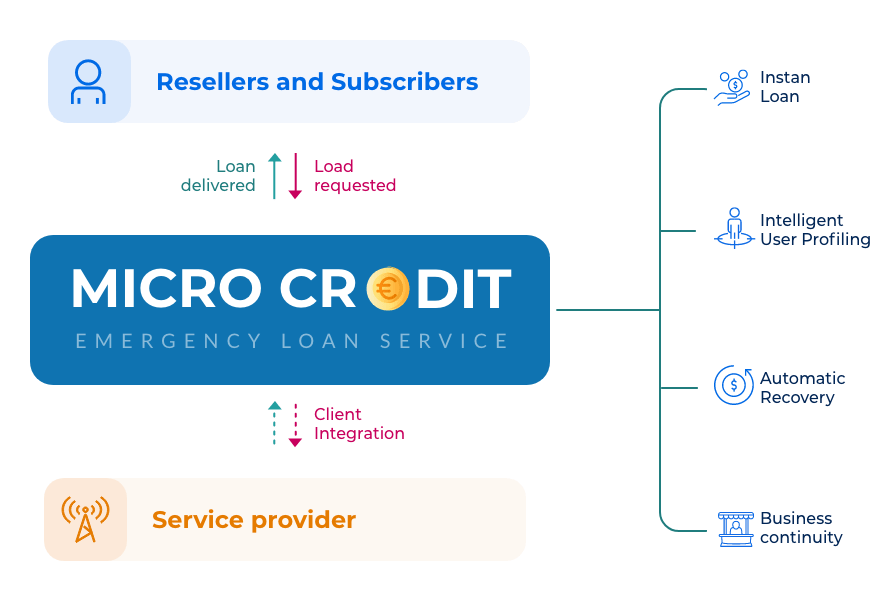

Offer micro-lending of emergency airtime to both resellers and subscribers with our end-to-end managed service that creates revenue without any interruption in your business, operations, and connectivity

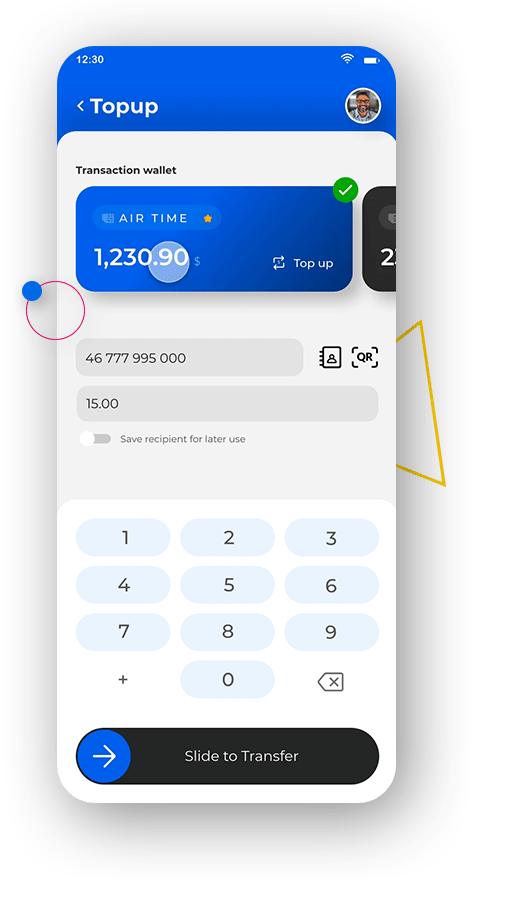

Provide instant loans for top-up throughMicro Credit

Trusted by the world’s fastest growing MNOs

Is Micro Credit right for you?

- You’re looking for value-added service that offers service continuation during odd times for both resellers and subscribers

- In doing this, you’d like to incur zero chances of default or the hassle of system maintenance

- You’re looking to add a new revenue stream in the form of service-fees gathered on each loan disbursed

How Micro Credit helps you grow your business

Sustainably grow your product and service usage

Minimize service usage disruptions and prevent revenue opportunities lost due to “zero airtime” by enabling distributors, resellers and subscribers to avail continued access to your services

Offer micro-lending across various categories

Extend small, short-term credits to services beyond prepaid airtime distribution to cover utility subscriptions like water, electricity, gas and more

Get nimble reports at your fingertips with our robust analytics

Generate rich reports from a variety of predefined and flexible templates complete with intuitive GUI, financial analysis, and service impact measurement data

Quality Over Quantity

How does it work?

Throughout this process, our system bears the entire cost and risk as we provide open and transparent reporting to the operator from loan requesting to loan recovery

Key Features

Subscriber profiling

To calculate loan amount in real-time based on intelligent user profiling

Customer Care Module

To empower the telecom operator to monitor performance and check transaction history through an interactive web interface

Subscriber Self Care Module

To enable subscribers to request and receive micro credit, check eligibility and access their account history through SMS, USSD and Web

Credit Engine

To create dynamic eligibility parameters by processing data and identifying a credit score for individual users their recovery details

Recovering Engine

To determine the recovery amounts and interact with the online recharge system to recover outstanding loan amounts

Our take on telecom industry

Learn more about industry strategies, best practices, and the latest developments in telecom