A woman living in the rural areas of Malawi runs a small general store. She does not have a formal education, and the financial needs of her business are not served by the traditional banks in the region. There are low transaction volumes amongst the rural population and high costs for banking, which have been a major deterrent for people in this area. Despite her lack of financial representation, this Malawi woman runs a business and is part of the financial system. Therefore, for her savings and economic needs, she turns to mobile financial services (MFS) and mobile money. As the number of people who have access to a sim card and mobile phone is almost double the number of people with bank accounts, MFS seems like a feasible option for her.

The already burgeoning mobile banking industry has gained fresh momentum in regions like Africa, the Middle East, and South-East Asia owing to the COVID-19 pandemic. Not only are service providers boosting technology platforms to facilitate mobile money, but the governments are also taking measures to curb coronavirus through contactless payments.

Head over to this blog to learn more about the strategic challenges presented by the pandemic and what actions are needed to provide uninterrupted services.

Evolution over time

It can be argued that in many developing regions, mobile money has followed a ‘user-centric’ evolution path, instead of a ‘technology-centric’ model. With the rapid growth of internet penetration rate and mobile networks, economies have employed mobile money solutions to address existing problems. Before 2007, peer to peer transfers or sending money to anyone was a big problem due to the low rate of banking. The mobilization of money was limited and express money orders were the only legal ways to send or receive money. For many developing economies like the Middle Eastern and Asia Pacific regions, the movement of money was based through SMS initially.

Gradually, with the proliferation of technology and widespread use of smartphones, mobile phones transformed into digital wallets. Consequently, by 2015, there were more than 270 mobile money services in 80 markets globally, half of which were based in Sub Saharan Africa.

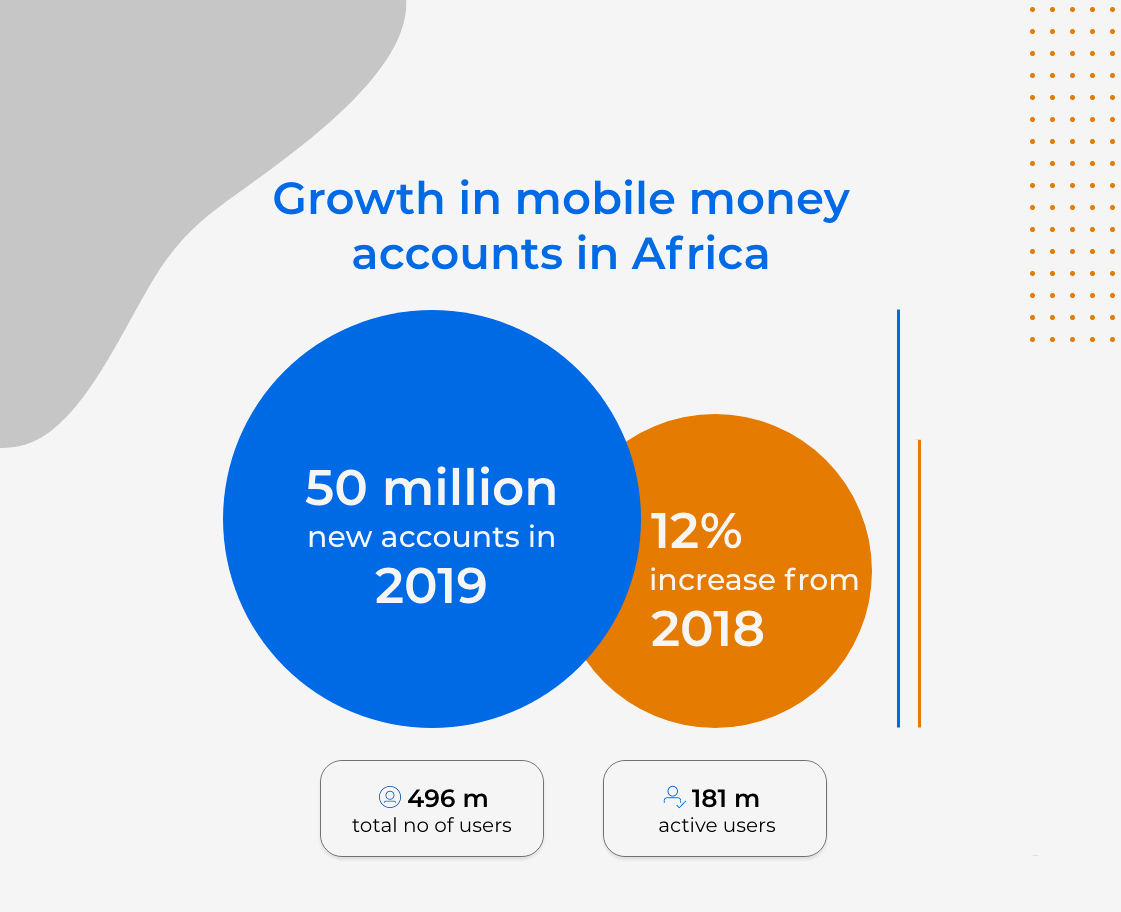

In 2019, Africa experienced a surge of 50 million new mobile money accounts that were registered through mobile phones, which amounted to a 12% increase from 2018. This pushed the total number of users to around 469 million, out of which 181 million were active users.

Why does Mobile Financial Services have a vantage point over traditional banking?

Although the penetration and reach of mobile money solutions have increased exponentially over the past decade, it has also faced some initial resistance from the banking industry. This friction was primarily driven by the fact that banks could not fully grasp the dynamics and impact of mobile banking; instead, they focused more on the risks and repercussions. The predominant challenge faced by the formal financial institutions like banks was that they were operating under the traditional, cash-based models with high costs, and catering to a limited customer base. Maintaining a customer account has a fixed cost associated with it, which makes it infeasible for them to offer their services to the lower economic segments of society. On the other hand, with the rapid adoption of innovative and easy access technology, consumers have shifted to convenient solutions like MFS that cater to wider customer segments.

Since the breakthrough of MFS technology more than a decade ago, new business models based around agent networks have emerged. Telecom operators, utilizing their existing reseller and agent network, are at the forefront of leading the world towards a more inclusive future. As opposed to traditional banking, the financial services provided by agents (agent banking) is not restricted by any specific region or working hours. This has led to the registration of agents on a wide scale, which in turn has led to a mass market of financial services for low-income groups.

Features and functionality of MFS

Even though it began as a basic money transfer solution, the mobile money solution today has evolved into a multi-tier service that enables subscribers to make digital transactions like peer-to-peer transfers, cash-in, and cash-out, etc. In addition to that, users (resellers) can also benefit from value-added services like multi-wallet features to enhance the convenience and user experience considerably. As a unified payment solution, mobile money allows the users to make payments in cashless mode seamlessly. The process behind registering a mobile money account ensures that sufficient data is there to establish the creditworthiness of the customer. This opens up various avenues to extend these services to people who otherwise lack the history or collateral to obtain credit. Additionally, this solution also has the ability to effortlessly manage heavy traffic with zero downtime.

Future outlook for mobile money and financial inclusion

In many parts of the world, people are moving towards cashless transactions through the wide-spread digital merchant payments powered by mobile money. The underlying aim is to compel merchants like gas stations, restaurants, stores, etc. to accept digital payments using simple point-of-sale (POS) devices or even just their mobile phones. Depending on the infrastructure and government regulations, the reach and adoption of mobile financial services have been varied across different economies. For instance, some technologically advanced nations are moving towards cashless societies, while developing regions tend to benefit more from improved financial inclusion.

To achieve efficiency and wide-ranging adoption for MFS, collaboration, and synergy between key players like banks and telecom operators is necessitated. This mutual collaboration begins with banks and telecom operators to expedite growth, allowing banks to increase their bottom line while telecom operators to expand their service portfolio.

Moving forward, the increased smartphone penetration will rewrite the course of financial inclusion by enhancing the user experience through rich interfaces. It is going to be the primary driver for accelerating product and service innovation in mobile money as companies bank on the opportunities presented by innovative technologies like smartphones.

Given the challenges and growth trends for mobile money, telecom operators need to leverage innovative digitization strategies, promote financial inclusion, and bank on diversified growth opportunities. Read this blog to learn more about what the future has in store for the telecom industry, especially in the context of digital transformation.