MNOs have faced their fair share of structural challenges, especially in view of the past two years of global crisis. However, there has also been a remarkable growth in areas like mobile connectivity, consumption of digital services, and digital transformation of businesses, with this growth wave still nowhere near saturation point.

With 2022 coming to an end, telecom CIO’s sector-wide need to consider new ways to improve their digital engagement and to keep their operations running smoothly. Therefore, the big question becomes: What steps can MNOs take to thrive in the near future?

The Telecom Revenue-Growth Newsletter

Our coveted monthly newsletter compiles vetted insights on creating effective sales and distribution chains that fulfil telcos' revenue goals. That, and a lot more.

Here’s a list of what will be covered in this blog:

From the dramatic shift to cloud platforms and microservices architecture to the adoption of 5G technologies, CIO’s are making heavy investments in automation and digitization of business processes.

This makes it pivotal for telcos to find the right technologies that fits their needs, and not only enables them to take advantage of the tech wave but also do it cost-efficiently.

So without further ado, the five emerging technologies that have taken the industry by storm include:

1. How can CTOs take growth leaps with 5G network technology trends

In a nutshell, 5G technology will change the role of MNOs from technology distributors to service providers. Wireless connectivity, which is a key catalyst for growth, is enabled by the deployment of 5G technology which is an essential building block for the interaction and connection of billions of devices of almost any kind.

Many operators have taken a leap and upgraded to 5G, which is now rapidly gaining pace and the motivation for this is driven by the desire to be the industry leader and to be ahead of the curve.

While digital giants are spending tens of billions of dollars on content creation, quite alot of MNOs are not equipped with the right technology platforms to deal with this major digital shift. This makes it critical for them to double down on what they know best; renewing focus on better infrastructure by harnessing the power of 5G for the use of digital solutions and platforms.

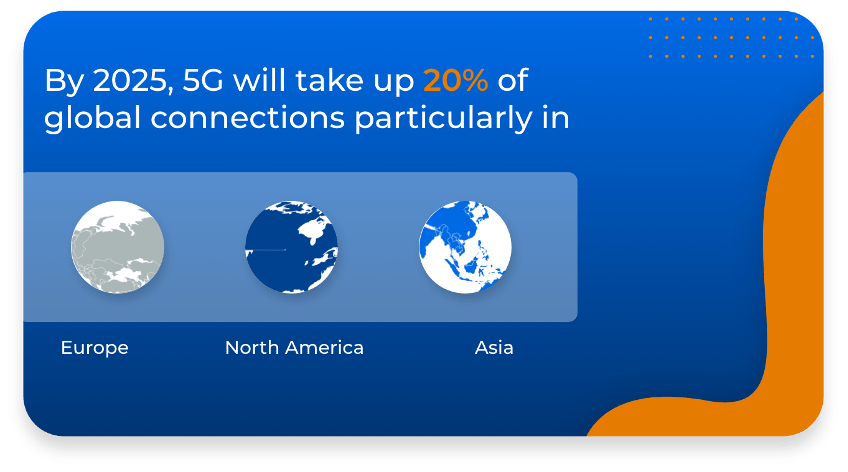

5G is expected to have a strong presence in the European, Asian, and North American markets. To support this generational shift and further drive consumer engagement, operators are expected to invest around $1.1 trillion worldwide between 2020 and 2025 in mobile CAPEX, roughly 80% of which will be in 5G networks. By 2025, 5G will account for 20% of global connections, with take-up particularly strong across developed Asia, North America, and Europe. (GSMA, 2020)

2. Consolidating the sales and distribution with IoT platform

In the stagnant telecom industry, where products and services are primarily commoditized, IoT solutions enable MNOs to expand their horizons with new and innovative offerings. They provide improved connectivity within the distribution chain which leads to greater cohesion and synergy between platform players like service providers and resellers. It also allows them to leverage current experience and knowledge about customer engagement to improve retention rates.

The usage and value of IoT for MNOs is more than just providing better connectivity to consumers. Instead of focusing solely on expanding network connectivity, MNOs can also reposition themselves as IoT access providers. They can further equip their supply chain partners with the right tools and knowledge to promote this technology.

IoT presents an opportunity for telecoms to not only turn unstructured data into actionable insights but also offer a range of diversified products and services which extend beyond their existing offerings. From location information to data usage patterns, telecoms can extract valuable information from the data running through their system with IoT technology.

With the help of IoT technology, MNOs will also be able to monitor and control their data centers and base stations remotely. This not only enables them to build trust with the other network players but is also highly relevant in the time of unprecedented pandemic. Through this, companies can also improve their customer experience by minimizing their downtime.

3. Leveraging cloud services to drive innovation and growth

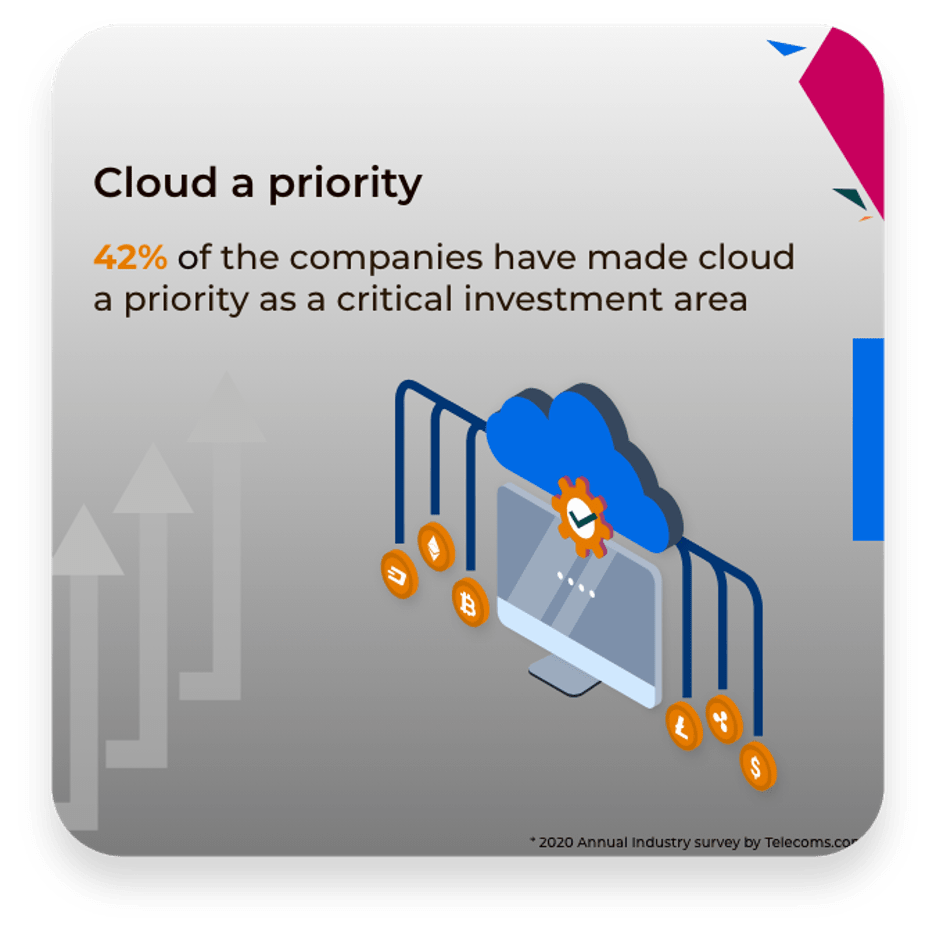

Cloud computing is one of the few technologies that can not only facilitate companies to recover from the crisis but help them thrive in spite of it. We can safely say that cloud computing has catalysed change and driven innovation in the telecom industry. By providing new platforms for creating and delivering business values, cloud allows companies to explore unique revenue growth opportunities. This has shifted the competitive landscape for telecoms, making it pivotal for them to follow suit.

Cloud native strategy establishes high and flexible scalability for telecoms by giving them the ability to scale up when the demand is at an all time high and allow them o scale back down when the chart falls to optimize costs. Since automation and adaptability are the building blocks for cloud and it is based on a well-architectured approach, it also allows for the timely self-healing of a system.

By leveraging cloud computing, MNOs can achieve faster time to market and minimize costs as they only pay for the services that they actually use. At Seamless, we transformed our entire information architecture from Monolith to Microservices to fully adopt a cloud-based approach to our products and to empower our customers in more ways than one.

4. Unlocking value with business intelligence & data analytics in telecom

In the era of advanced digitization and fast technological development, the use of business intelligence and real-time insights is becoming increasingly popular in the telecom industry. Deriving localised and actionable insights through smart and advanced analytics solutions are the gateway for achieving strategic growth objectives for MNOs.

A competent analytics platform can facilitate MNOs in extracting value and optimizing their operations by increasing their visibility across their distribution network, and allowing them to track the performance of their agents at the same time. Through it, telcos can also get to the root causes of their problems and both fix prevailing issues and take preventive measures to avoid future roadblocks. In the long run, it can allow CIOs to effectively deal with their emerging and unique business needs, successfully create new customer experiences, and also underpin their major strategic goals.

5. Optimizing investment decisions & tracking performance with Smart Capex

Network investment decisions are among the most difficult for operators to address. According to GSMA, network operators are expected to spend 1.1 trillion dollars in CapEx infrastructure between 2020 and 2025, making CapEx optimization at the top of the agenda for telecom CIOs.

By using a high-caliber solution that eases this decision-making, MNOs can select their optimal network investment candidates that maximise the impact of the entire plan while matching the operator’s commercial, financial and technical constraints. What’s even better is that the CapEx efficiency gained can then be translated into overall budget savings or reallocated to other projects.

Telecoms can further use the insights offered by the solution to make informed, timely, and data-driven granular investment decisions to achieve higher ROI.

Final thoughts

The last 2 years have been defined by resilience, recovery, and defensive strategies for telcos, but with 2023 looming ahead, it is now time for them to take the reins back and go on offense. It is pivotal to step forward from the sidelines and take initiative regarding digital transformation and innovative tech solutions. This is especially important since the market trends that were once categorised as ‘new and emerging’ are now ‘evolving and maturing’ across telecom.