Telecom operators are striving to build an ecosystem that is customer-centric and serves the objective of consistent and sustainable growth. The main strategy is to further develop core business and digitize operations in order to maximize value. Hence, there is increased investment in diversified growth verticals to move beyond conventional mobile services.

There are three main areas of telecom strategic investments that will form the backbone of growth and increased profitability in the year 2021 and onwards:

Growth in mobile financial services

Telecom companies have been expanding their operations, covering a wider on-ground area in terms of coverage, rapidly over the past few decades while also growing their subscriber base. However, having hit a saturation point in the number of subscriptions, they are faced with two major challenges;

- Plunging revenues for traditional services, and

- Fierce competition in the form of rapidly expanding value-added services by other players in the market.

This has put telecom operators in a position to seek unconventional and untapped revenue sources and strategic initiatives that would not only let them grow but also help to diversify their portfolio. Mobile financial services and its value-added features present high growth opportunities for telecoms, given the right push through retail chains.

There has been a significant consumer behavioral shift from cash to digital payments and eCommerce. For the industry, this means that ‘payments as a platform’ is a successful model which not only facilitates higher digital value but also allows telecoms to tap into new revenue streams.

Undeterred by the lack of adequate infrastructure for mobile financial services, mobile money has had unrivaled success and significant market penetration in developing regions.

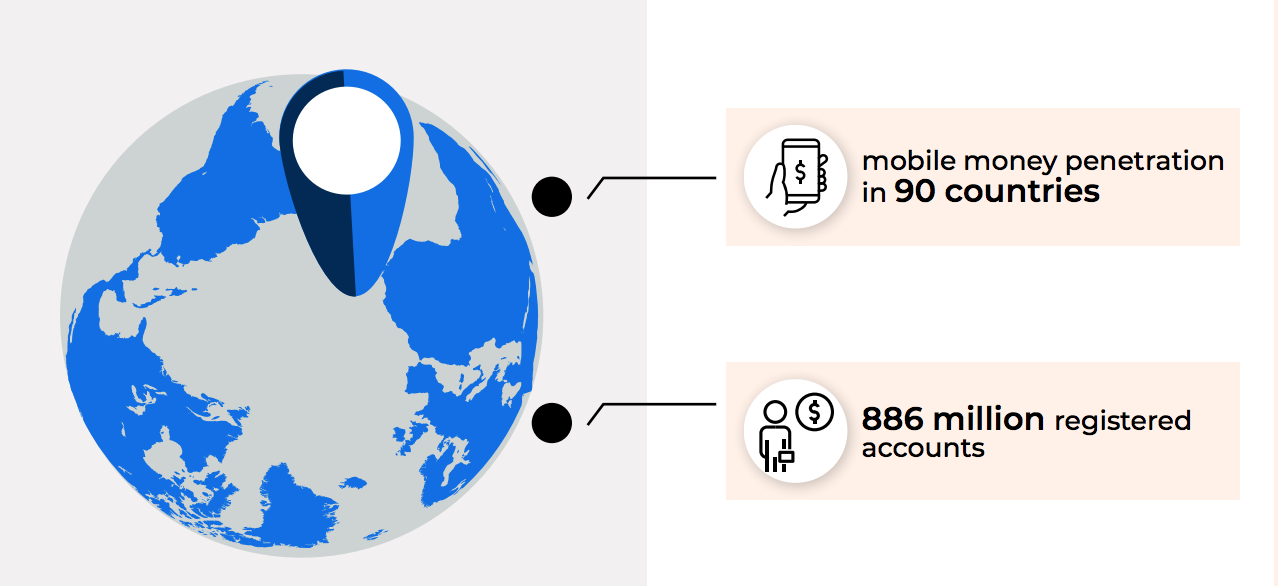

Mobile money penetration now spans more than 90 countries across the globe and represents around 886 million registered accounts. From a global standpoint, the growth rate for mobile money in 2019 has grown by an astonishing 20 percent since 2017; and out of this, a large percentage of registered mobile money users are represented by Sub-Saharan Africa.

In the future, mobile money will also be relevant for other sectors like e-commerce and transport where traditional financial services have been predominant mainly. This serves a huge potential and an unbanked opportunity for businesses to grow and boost their revenues.

Enhanced customer experience

Customer retention and a low customer churn rate are critical success factors, and telecom companies need to go beyond just fixing the routine challenges and hassles of customers to perform well against their competition. Telecoms can capture customer loyalty and sustain positive customer sentiments towards the brand by offering value-added services and ensuring availability and active service across all key points of interaction.

Early adoption of disruptive technologies and digital transformation is the most direct path to establish leadership in the market. Telecom operators should also employ technologies like artificial intelligence to offer personalized customer service. By leveraging smart tech, the ultimate aim of telecom operators is to derive data-driven insights from the customers, and through that provide personalized service at the right time and through the preferred channel.

This generation of tech-savvy customers demands that their service provider should be available to engage and communicate through various channels. Therefore, telecom operators need to upgrade their Sales and Distribution to provide a smooth and consistent customer experience through all touchpoints and keep up with the digital, multi-device, and demanding lifestyle of the customers.

Reducing OPEX through digital transformation

In response to the rise in mobile penetration and wide adoption of consumer technology, telecom operators have been compelled to undertake initiatives that have a direct negative impact on OPEX.

While providing these customized services can provide a competitive advantage to companies, it can also increase OPEX, hence shrinking the revenue margins. Optimizing OPEX is a critical pain point and a priority area for telecom strategic investments that improve the bottom line. There are various initiatives that can be undertaken within the sales and distribution network. With the increased use of digital solutions for operations and logistics, the amount of time, effort, and costs can be dramatically reduced. OPEX can also be lowered by consolidating the number of solutions that are being used for sales and distribution for direct and indirect channels. This would essentially enable the companies to cut back on costs, enhance the customer acquisition efficiency, and improve the overall operating profitability. Automation and digital transformation in the core processes would subsequently lead to operational efficiency and optimal use of human and financial resources.

Head over to our guide “Trends and strategic initiatives to achieve Telecom growth objectives” to learn more about the telecom strategic investments that can be employed by telecom CIOs to drive sustainable growth and optimize costs for their organizations in a dynamic market.