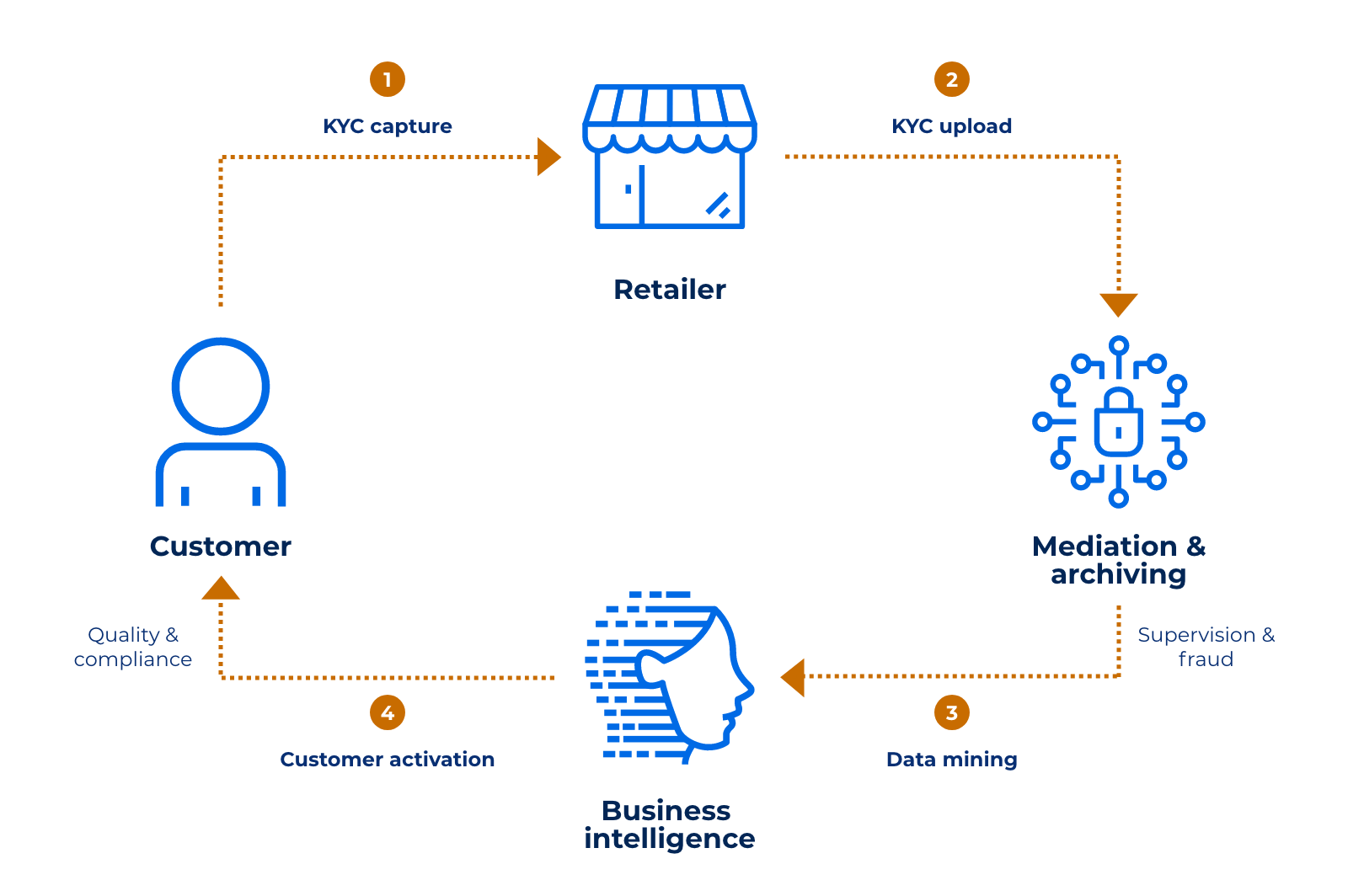

Traditionally, the process of KYC (Know Your Customer) is not only time-consuming but also heavy on the pocket of telecom operators, making it highly inefficient. However, this cumbersome process can be simplified by an integrated, secure, and real-time digital KYC process.

An end-to-end digital KYC enables the telecom operators to not only streamline their processes but also to improve the onboarding process with the elimination of manual record-keeping and paper based procedures. In addition to this, it reduces the costs and time spent on onboarding and verification by a significant margin.

Why is digital KYC indispensable for telcos?

Generally, there is a high risk of sim card fraud is a growing concern for many telecom operators across the globe. Owing to this, telecoms are exploring the concept of digital Know Your Customer (KYC) process of new prepaid sim users in an effort to save costs, onboarding time, and to make the experience more user-friendly.

The simplified process and highly intuitive user interface provides ease of use for all entities including telecom operators as well as their agents that perform KYC. Additionally, the real-time platform provides improved control and traceability of data with ever increasing commercial cross-sell opportunities. The fully integrated and automated process from initial on-boarding (data capture) to managing the entire data lifecycle of entities reduces chances of manual entries substantially.

Intelligent and dynamic KYC platform

Digital KYC allows a service provider to meet their specific user data capture needs, from initial on-boarding throughout the entire customer lifecycle. Service providers can enable the customer on-boarding process through multiple sources according to the business needs as well as technological advancements in their operating location. Electronic KYC services are offered through basic channels (USSD) or more advanced ones (mobile application, dedicated data capture devices or a web portal). The digitization of the KYC process enables the telecoms to reach remote customer bases and also substantially increases the accuracy and efficiency of the entire process.

Digital KYC platform offers a full range of customised solutions that can be easily integrated with any legacy and third party systems for fast implementation and has a multi-staged customer identification program:

Data capture: Allows seamless, quick and real-time capturing of customer data through various access points. Customer’s personal details are captured and submitted as part of the first stage of KYC.

Proof of data: Collect proof of customer information and improve data quality and integrity. Documents that support customers’ claims are collected and stored as part of the second stage of KYC.

Data verification: The most advanced stage of KYC is when customer data is verified automatically by the system through various integrated sources.

Advanced: Allows for “points” system to verify customer data. It requires subscribers to provide multiple supporting documents to prove their identity, with a predefined minimum number of points to qualify.