Mobile Financial Services (MFS), and more specifically digital wallets, have been a predominant growth driver in the telecom industry but they gained dramatic momentum owing to the pandemic over the last few years. As a primary medium for enabling financial transactions digitally during this critical time, MFS became an integral part of the lives of millions of mobile users, especially in emerging cash-based markets.

Current Situation

Although the banking industry is a mighty force to be reckoned with, they have not been able to keep up with the growing financial needs of the consumers. Over the past decade, it has become apparent that the banking sector has failed at making financial services accessible to a wider audience.

At the same time, given the speed with which telecom operators are moving towards universal accessibility for their services, they are quickly beginning to penetrate into the finance sector as well. The far reaching services of telecoms, especially in remote and rural areas where financial inclusion of the population is quite poor, have made it easy for people to see telecom retail points of sale as immediate alternatives to banking and financial services. This has played a pivotal role in diversifying revenue streams for telecom operators.

Mobile financial services and its value-added features present high growth opportunities for telecoms, given the right push through retail chains.

A robust MFS platform allows users to transform their mobile devices into a digital transaction and payment engine that has the ability to cater to both, banked and unbanked sectors.

Armed with this, MNO’s stand to benefit by:

- Generating new transactions flow securely and easily;

- Attaining faster settlements for merchants;

- Expanding their customer market share and retail footprint substantially

- Achieving reseller loyalty through assured business continuity

How can MFS be utilized to address the gap in the market?

In the past few years of global upheaval, mobile money has offered a financial lifeline to millions of unbanked, unrepresented, and marginalized people globally. With the recent changes in the global economy, it is becoming increasingly evident that MFS can be used to offer safe financial support through digital transactions and payments.

As per this GSMA 2021 report, mobile money platforms have taken a great leap forward, from merchant payments through mobile money platforms which reported an increase of 43% in 2020 to the value of digital transactions which grew fourfold in the last five years with a staggering $68 billion in 2020.

Mobile money and digital wallets offer a secure, and cost effective solution for telecoms to expand their customer footprint with little to no risk. By deploying MFS solutions in conjunction with their vast network, telecom operators can tap into markets that were previously overlooked to grow another revenue stream.

How does it work?

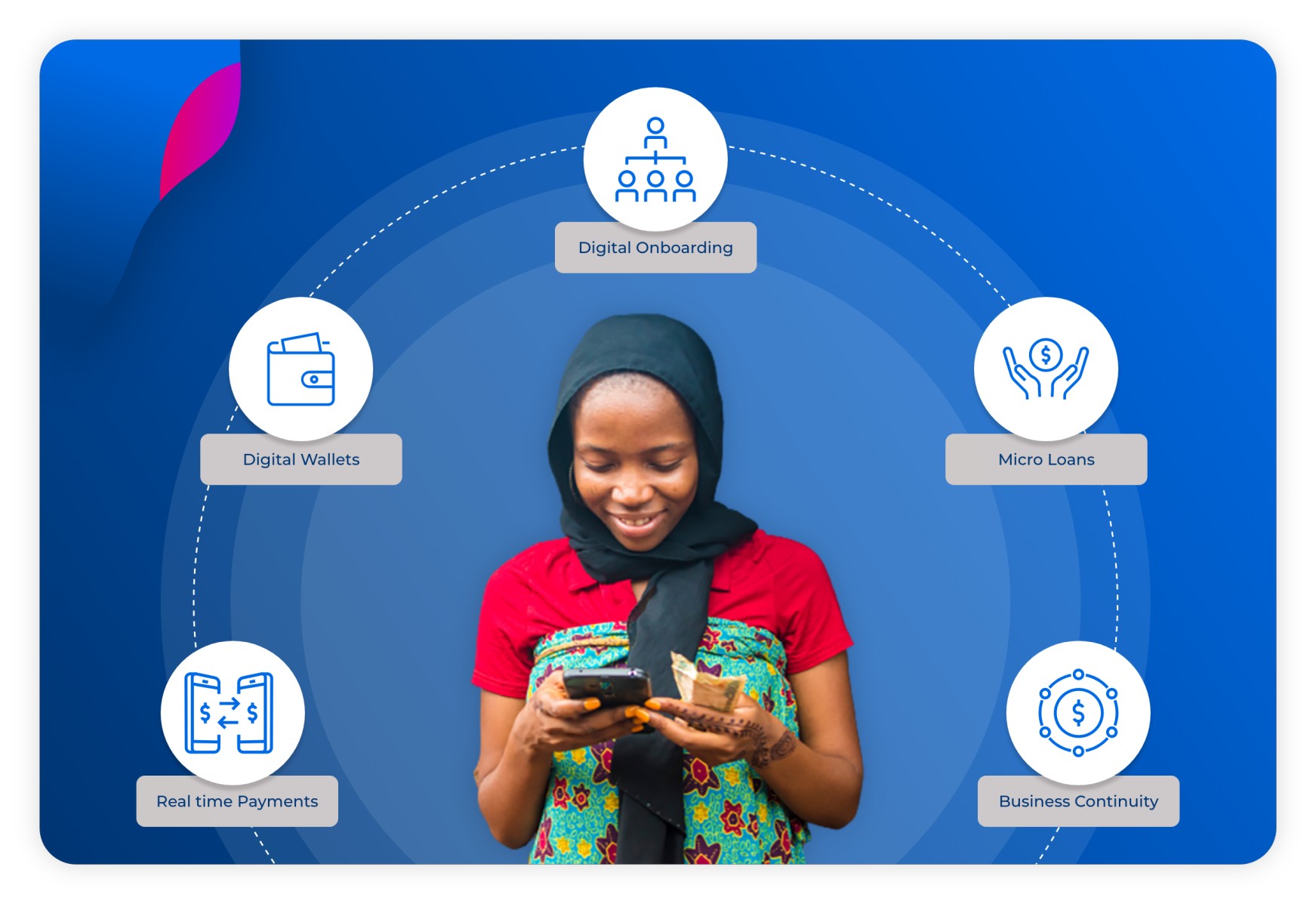

MFS solutions are scalable and secure and enable payments or financial transactions in real-time. The basic functions of a mobile money platform like peer-to-peer transfer, payments to merchants, cash-in, and cash-out, are a necessity in today’s world.

While this is a fast evolving field, currently MFS consists of digital wallets that are value accounts that store money as “credits” in the MNOs ecosystem. Wallets can be “loaded” or “unloaded” through cash-in/cash-out at POS locations.

Another key feature that makes next-gen platforms stand out is that of digital onboarding. A competent MFS platform can digitize Know Your Customer (KYC) to reduce the manual time and effort required to onboard subscribers and resellers. Instead of an agent visiting multiple resellers for onboarding, the digital KYC accelerates the process through fast, accurate OCR-based document capture, and authentication to fulfill KYC requirements for due diligence, and regulatory compliance needs..

In the context of financial inclusion, the MFS platform also enables MNOs to extend micro-loans to resellers, which in turn presents a unique growth, engagement, and revenue opportunity for them. This also translates to higher service revenue as telecom operators would get a small fee on every micro-credit that is offered.

The POS resellers, on the other hand, benefit from business continuity as they can purchase digital stock to sell directly through their mobile money accounts, without having to visit their distributor or waiting for the sales agent to credit the stock. With intelligent user profiling, credit rating, and auto loan recovery processes, the telecom company would assume little to no risk in the entire process.

Final Thoughts

As a synergized intersection between technology and finance, mobile money is a financial innovation that allows digital transactions at little to no cost. By adapting to the prevalent MFS and mobile banking trends in the industry, telecom operators would not only be able to benefit from new revenue streams but also have the capacity to dramatically change their profit formula.

The mobile money platforms are armed with the capabilities to provide scalability and growth opportunities for the telecom companies and to transform the emerging economies significantly. Insights from GSMA 2021 shows that some of the most prominent markets for mobile money will be Pakistan, Liberia, Kenya, Uganda, and Ghana, in near future. The impact and reach of MFS is not only limited to the telecom industry as it has expanded to other major sectors like commerce, health insurance and agricultural banking as well with no signs of stopping.