Despite spanning across its second year, the coronavirus pandemic has maintained its tight grip on the telecom industry and the challenges it brings continue to test the agility and resilience of even the top telecom players across the globe. The consequent series of ‘black swan’ events, like nationwide lockdowns and mandated social distancing, have added to the pain by casting doubts in the existing processes and systems that exist within telcos.

COVID’19 Pandemic Challenges

The long drawn pandemic has taken its toll on telecom sales and distribution networks, especially considering that the footfall of customers at direct franchises has been a major revenue source for the longest time. In many regions, the telecom sector is still reeling from the social distancing measures which has caused an abrupt disconnect between the retail Point of Sales (POS) and subscribers. In spite of the significant growth in the adoption of digital channels, the digital divide in many regions like Africa and the Middle East has been a roadblock.

As the pandemic restrictions loom over telecom operators, they experience a growing need to develop a robust digital ecosystem to overcome the vulnerabilities in their existing systems. In an effort to stay resilient in the face of future inevitable events like the Covid-19 pandemic, it is pivotal for telecom companies to increase investment in digital transformation solutions for S&D.

Even though many telecom companies are moving towards digitization to bounce back post COVID-19, the inconsistency and lack of synergy in overall sales and distribution (especially across direct and indirect channels) has impeded their growth.

Opportunities for Telecom Operators

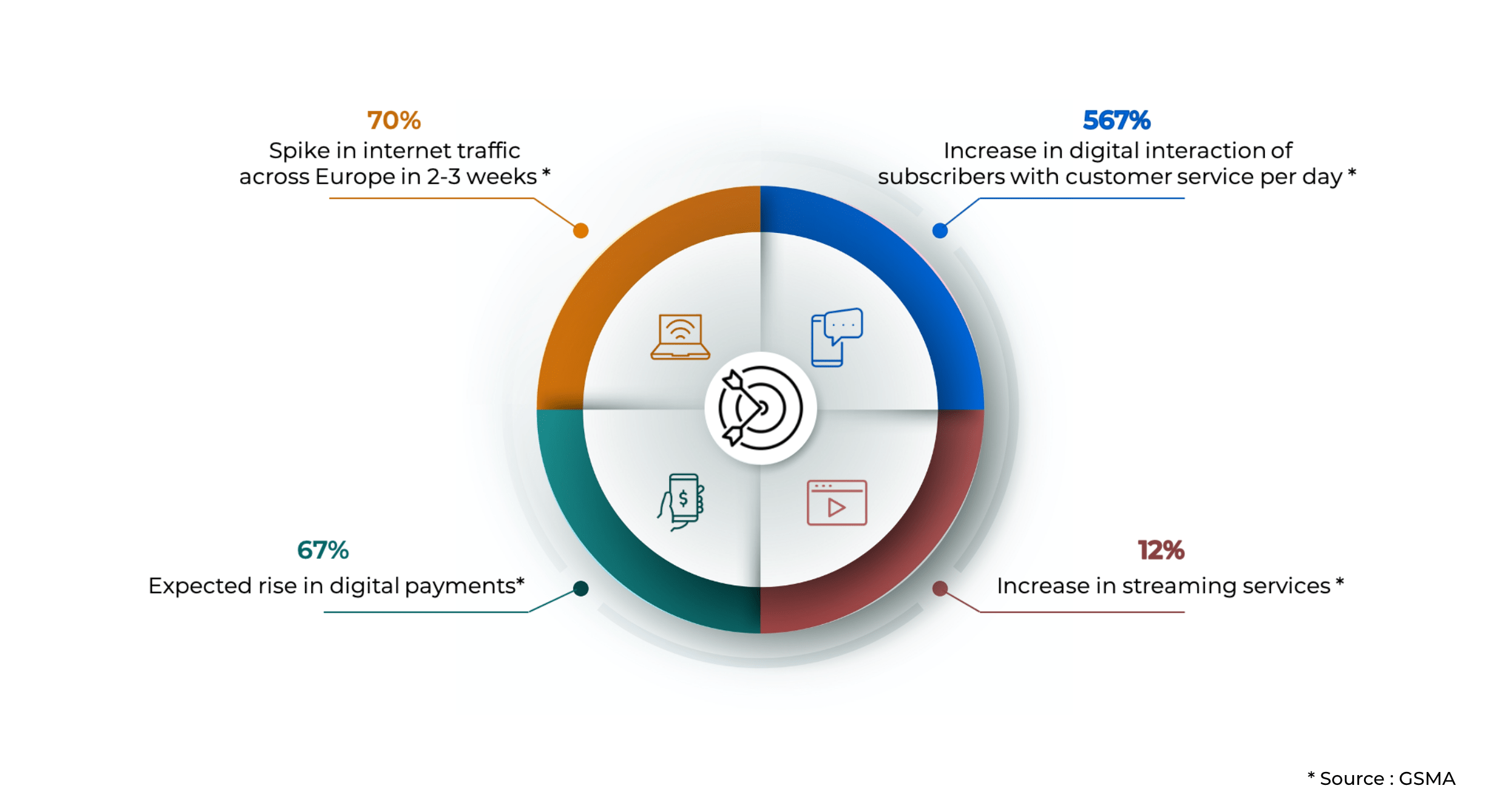

Irrespective of the disruptions prompted by this pandemic, telecoms in general have benefited from the industry growth trends and increased adoption of digital platforms. The unexpected surge in digital connectivity and a global shift towards digitization presents new and unbanked opportunities for telecom operators. There has been a spike in revenue for telecom players, predominantly because of the increase in mobile and internet usage, along with enhanced digital interactions.

The dramatic increase in demand for digital services and interaction and traffic has demonstrated the reliance on digital connectivity and channels of distribution. Telecoms need to realign and consolidate their sales and distribution network to ensure retail enablement across all customer touch points and boost revenue in the changing industry landscape.

During the pandemic, some telecom operators have shifted their focus from playing defense to improving growth by tapping into new revenue streams, including digital payments and mobile money.

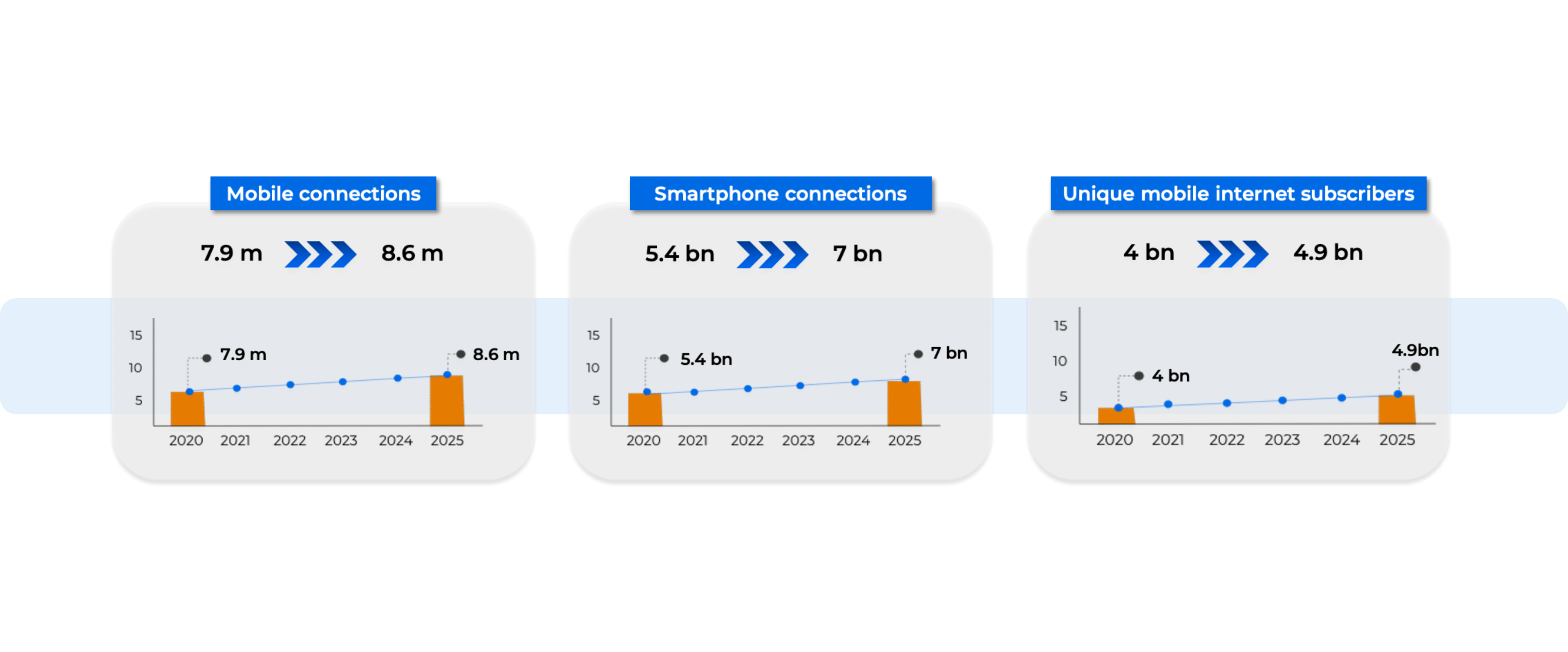

These growth trends are further substantiated by the mobile economy growth forecasts from 2020 – 2025 as highlighted by the GSMA 2020 report.

It is important to note that a large part of these new connections (around 66%) will be added from the Asia Pacific and Sub Saharan Africa regions. Given that around 800 million people in African region still do not have access to mobile internet (GSMA intelligence, 2020), this serves a huge potential for telecoms to generate revenue through the digitally excluded population.

Conclusion

To combat these challenges and get a leg up on the competition, telecoms need to improve control, transparency and visibility throughout the supply chain network, be it direct or indirect. The past year and a half has shown how to enhance the overall customer experience, telcos need to pivot to an integrated solution that covers all dimensions of the customer’s journey through end-to-end visibility and management of the S&D ecosystem.