The Telecom Revenue-Growth Newsletter

Our coveted monthly newsletter compiles vetted insights on creating effective sales and distribution chains that fulfil telcos' revenue goals. That, and a lot more.

Here’s a list of what will be covered in this blog:

Introduction

In 2025, telcos everywhere are feeling the same crunch. Revenues that looked stable up until a couple of years ago are now barely increasing. According to PwC, Global revenues at over 4% a year in recent years are now slowing to under 3% CAGR through 2028. Average revenue per user continues to decline, yet costs are still high, and the market is full of new players, hyperscalers, satellite companies, OTT disruptors, all chipping away at share.

And even after spending billions on 5G, cloud, new tech, the big question that keeps coming up in boardrooms and at industry events is the same: “How do we actually grow again?”

One technology keeps coming up in these conversations as the answer is AI, but the way most telcos are approaching it is exactly why it hasn’t delivered on its promise yet.

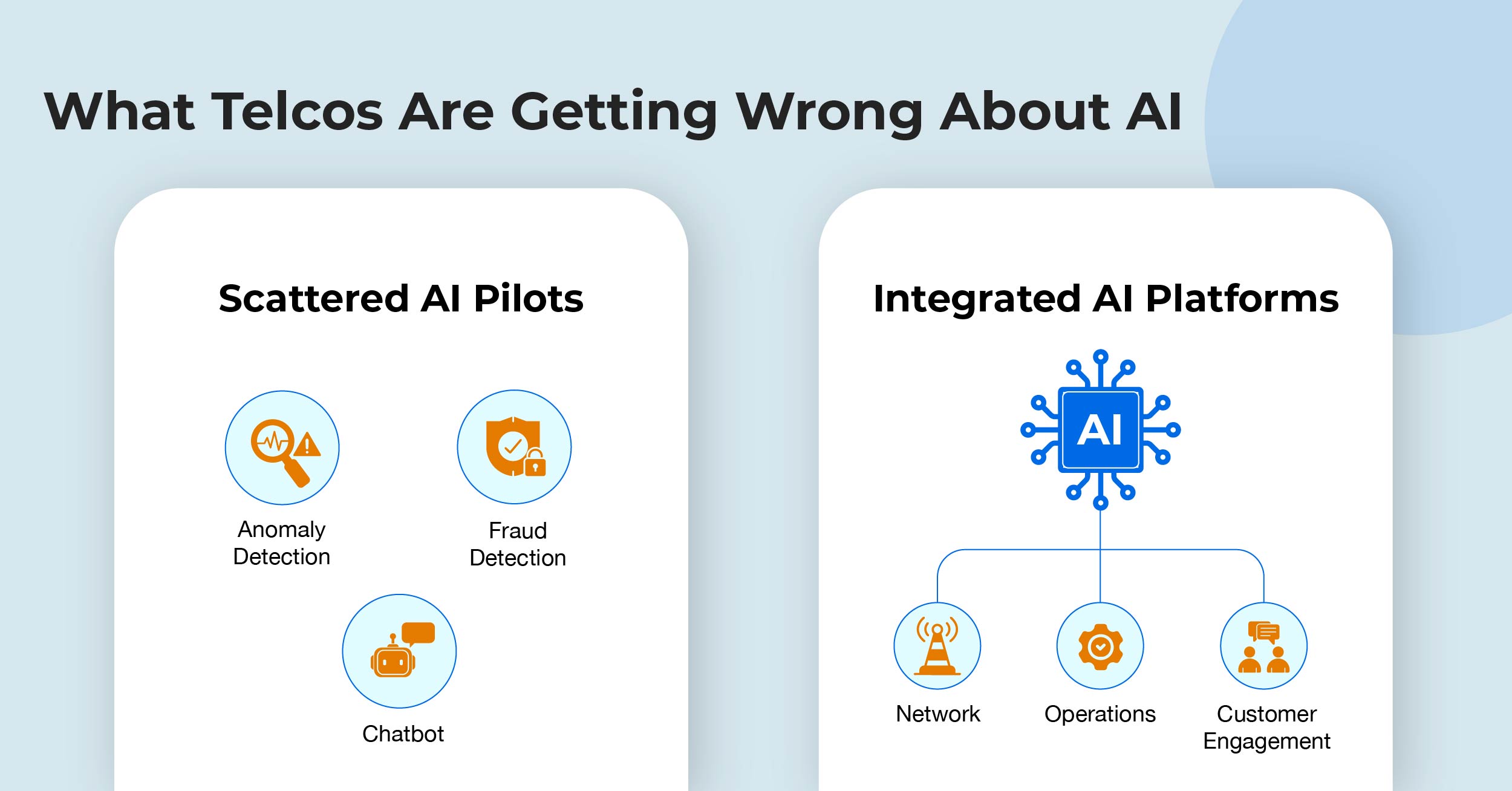

What Telcos Are Getting Wrong About AI

AI in telecom is not new, but in the rush to be first movers, most telcos have treated AI as a patchwork of tools and pilots. Every operator has tried something, a chatbot here, a fraud detection model there, but most of these efforts have been scattered. They make small improvements, but because they stay disconnected from the rest of the business, they rarely add up to something bigger.

This is the real problem: as long as AI is treated like a set of separate tools, it will only ever solve small problems. It’s when AI starts to sit at the heart of how the company works, cutting across planning, operations, and customer engagement, that things begin to change in a meaningful way.

What an AI-powered Telco Really Looks Like

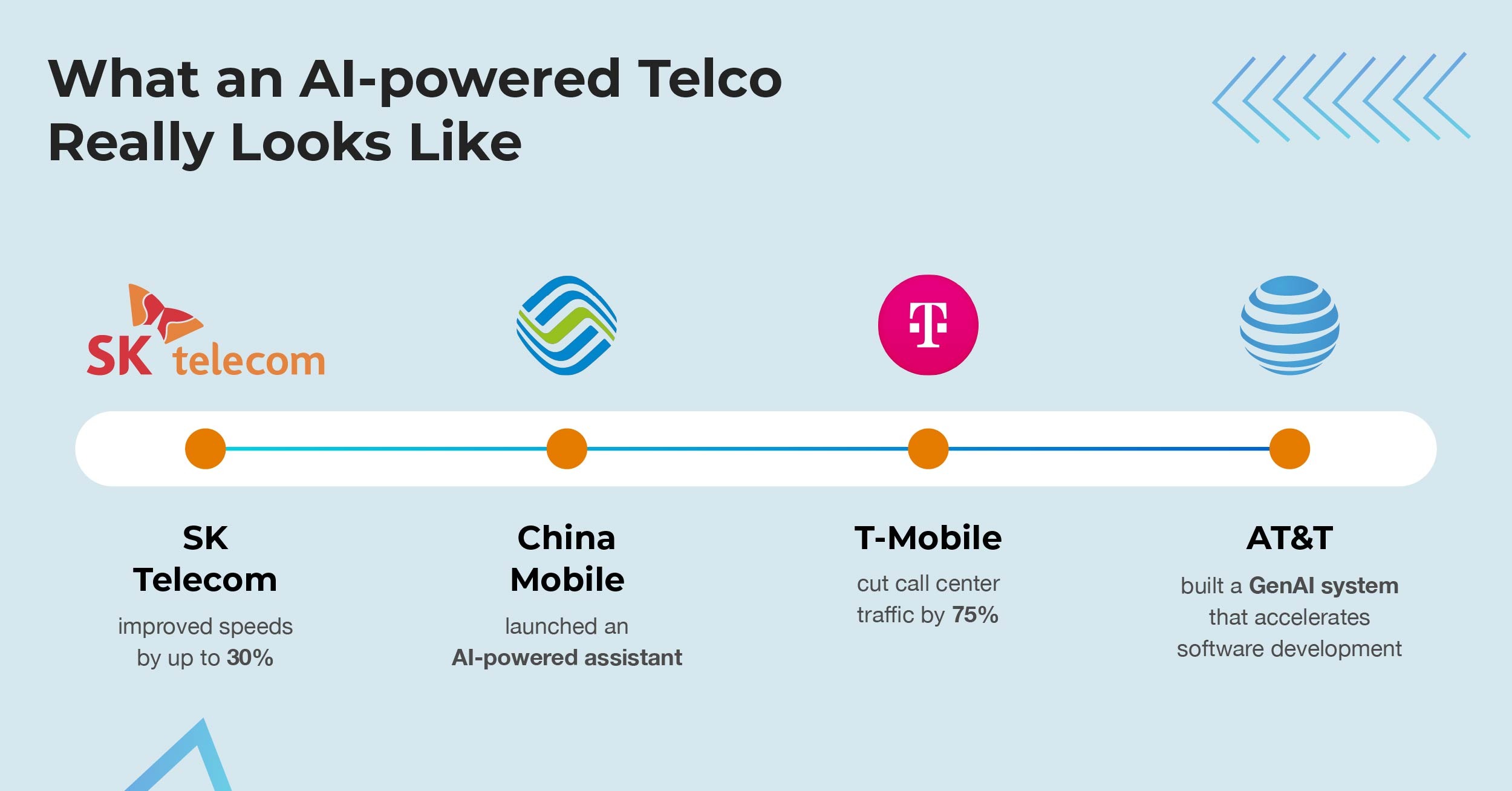

We are starting to see the difference now as some operators move away from experiments and start baking AI into the way they work. Recent industry studies from Kearney and PwC showcase some of the most striking examples of how AI is already delivering results:

- China Mobile used AI on 1,000 different network parameters and saw speeds go up – 13% outdoors and 30% indoors

- SK Telecom has made AI one of its big pillars and plans to triple its AI investments by 2028.

- T-Mobile built a platform called IntentCX that predicts what customers need and has cut the number of people calling their help centers by three quarters.

- AT&T built their own gen AI system that saves minutes on every customer interaction and even makes software development faster.

These outcomes show what happens when AI in telecom moves beyond pilots. They also point to a bigger undertaking: turning these isolated successes into industry‑wide results will take overcoming the structural limits that have held operators back for years.

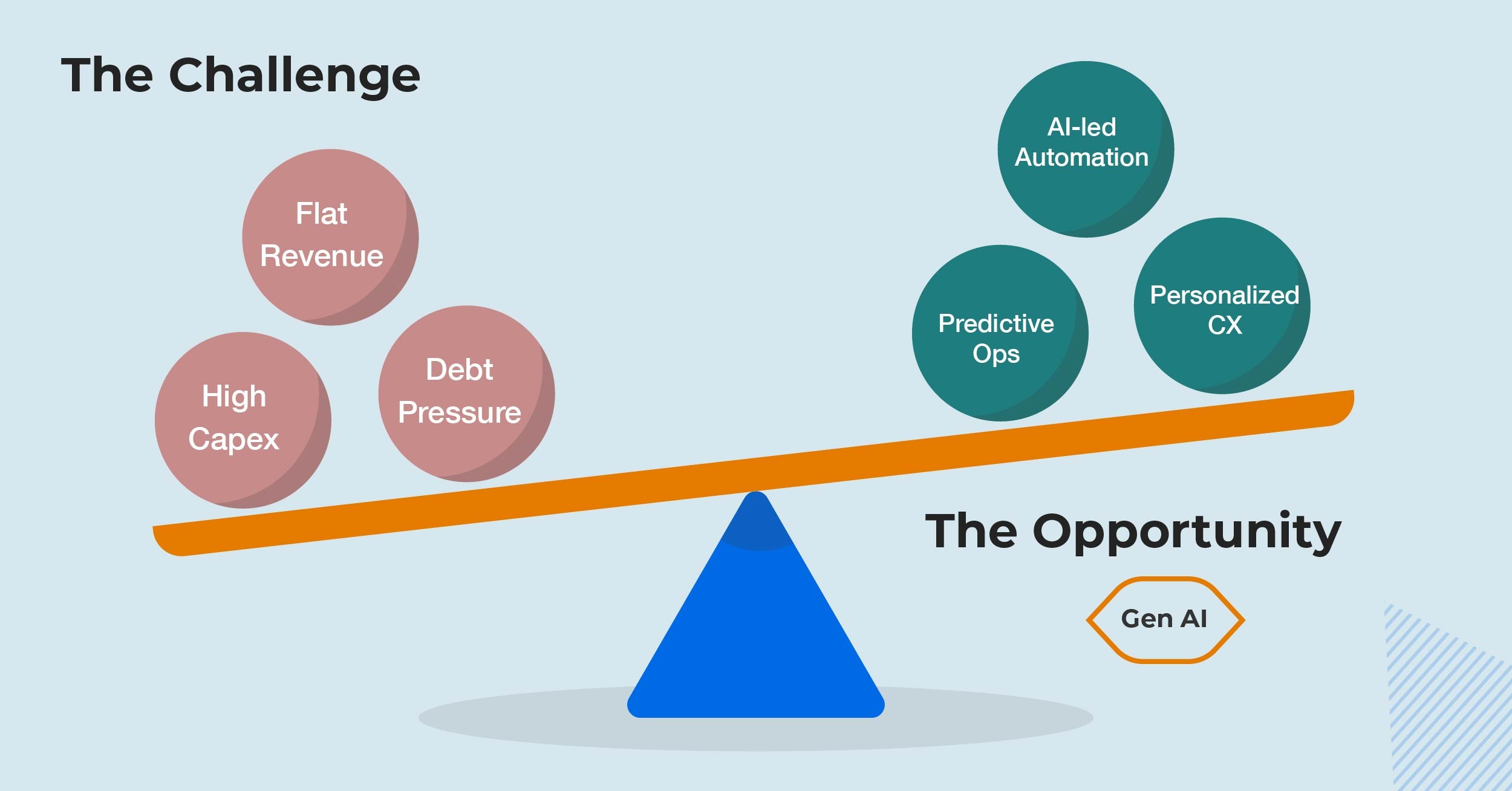

The Challenge & the Opportunity

Most operators today are facing the same constraint: there is very little free cash left to work with. As PwC notes, the majority of what operators generate continues to be absorbed by network investments, spectrum, dividends, and servicing debt. After that, there is little room left for innovation or new growth initiatives.

At the same time, commoditization has kept margins under constant pressure. Prices are difficult to raise, and costs keep increasing. This combination of high capital pressure and flat revenues has left the industry in a holding pattern, even after years of network upgrades and digital transformation programs.

This is where AI in telecom, specifically generative AI, is emerging as a potential inflection point. Deloitte has called it the single most discussed growth lever for 2025, precisely because, when deployed at scale, it can break this cycle.

By automating resource-heavy processes, unlocking the value of existing data, and predicting where attention is needed before issues escalate, AI can free up the capacity to focus on what drives outcomes: faster service, more personalized experiences, and growth in areas that were previously difficult to reach.

Though not a silver bullet, it represents one of the clearest opportunities in years for operators to reset. And that reset will depend on their ability to move beyond small pilots and make AI in telecom a capability that runs across the entire business.

Making AI Work at Scale

To turn early wins into system-wide transformation, telcos must now scale what works. The operators that are starting to see results are those that have shifted from experimenting with individual use cases to building unified platforms that embed AI into the way the business runs.

When AI is approached this way, the effect compounds as networks become more resilient and self-correcting, issues are identified before they grow, and teams are able to act on insights rather than react to problems. Customer engagement also adapts, moving from reactive service to proactive, personalized interactions, and decisions across the organization become faster and better informed because the same intelligence is available everywhere, to everyone.

This is why many operators are now looking at integrated AI capabilities like Seamless AI, which, instead of scattering projects across teams, brings them together on one infrastructure, with pre-built applications, managed services, and strong governance.

The result is a system that cuts through complexity: networks that can self-heal, customer engagement that anticipates instead of reacts, and operational intelligence that makes the business faster and leaner.

In markets where this model has been applied, AI-led orchestration has already helped telcos reduce inventory leakages by 15–20% while managing over 75 million SIM cards across vast reseller networks. These gains show how AI, when operationalized, delivers impact far beyond a chatbot or a one-off automation.

Final Thoughts

After decades of competing on coverage and capacity, the telecom industry is entering a different kind of race: shaped by how operators use AI to act faster, see clearer, and anticipate customer needs.

AI in the telecom industry is not a quick side experiment anymore. It is becoming the foundation on which the next phase of telecom growth will be built. The operators that move beyond pilots and embed AI into how their business actually runs will be the ones to break out of the cycle of flat growth and rising costs. Those who hesitate risk being left behind in a market that is moving fast.

The window to make that shift is open right now. The challenge for operators is whether they can act on it quickly and decisively enough to use this technology to kickstart sustainable growth.